Market crash: Investors become poorer by ₹13 lakh crore; Sensex tanks 2.27% in two days

In just two days, equity investors faced a staggering loss of ₹13 lakh crore in market valuation as the BSE benchmark Sensex saw a sharp 2.27% drop. The benchmark index shed 1,805.2 points, with a 984.23-point decline on Wednesday, November 13, 2024, ending at 77,690.95. Experts cited soaring retail inflation, which hit a 14-month high of 6.21% in October, persistent foreign fund outflows, and muted corporate earnings as the primary reasons behind the significant market correction

Market crash: Investors become poorer by ₹13 lakh crore; Sensex tanks 2.27% in two days

In just two days, equity investors faced a staggering loss of ₹13 lakh crore in market valuation as the BSE benchmark Sensex saw a sharp 2.27% drop. The benchmark index shed 1,805.2 points, with a 984.23-point decline on Wednesday, November 13, 2024, ending at 77,690.95. Experts cited soaring retail inflation, which hit a 14-month high of 6.21% in October, persistent foreign fund outflows, and muted corporate earnings as the primary reasons behind the significant market correction

Indian Rupee Holds Steady at 84.39 Against US Dollar, Supported by RBI Efforts

The Indian rupee opened at 84.39 against the US dollar on Wednesday, remaining near its all-time low of 84.4162. The Reserve Bank of India (RBI) is continuing its efforts to stabilize the currency, with analysts Amit Pabari and Anil Kumar Bhansali suggesting that the ce

Indian Rupee Holds Steady at 84.39 Against US Dollar, Supported by RBI Efforts

The Indian rupee opened at 84.39 against the US dollar on Wednesday, remaining near its all-time low of 84.4162. The Reserve Bank of India (RBI) is continuing its efforts to stabilize the currency, with analysts Amit Pabari and Anil Kumar Bhansali suggesting that the ce

RBI's Gold Reserves Increase to 854.73 Metric Tonnes Amid Economic Uncertainties

The Reserve Bank of India (RBI) has reported an increase in its gold reserves, which now stand at 854.73 metric tonnes as of September 2024, up from 822.10 metric tonnes in March 2024. According to the half-yearly report on the management of foreign exchange reserves released on Tuesday, this increase indicates a strategic shift by the central bank amid rising geopolitical tensions, persistent inflation, and a stable interest rate environment. Out of the total gold reserves, 510.46

RBI's Gold Reserves Increase to 854.73 Metric Tonnes Amid Economic Uncertainties

The Reserve Bank of India (RBI) has reported an increase in its gold reserves, which now stand at 854.73 metric tonnes as of September 2024, up from 822.10 metric tonnes in March 2024. According to the half-yearly report on the management of foreign exchange reserves released on Tuesday, this increase indicates a strategic shift by the central bank amid rising geopolitical tensions, persistent inflation, and a stable interest rate environment. Out of the total gold reserves, 510.46

"RBI Cuts GDP Growth Forecast to 6.8% Amid Festival Season Optimism"

The Reserve Bank of India (RBI) has reduced its GDP growth forecast for India to 6.8% for the second quarter of fiscal 2024-25, a decrease of 20 basis points. In its October bulletin titled "State of the Economy," the RBI attributed this revision to a slackening momentum observed in some high-frequency indicators, which were partially impacted by unusual heavy rainfall in August and September. This latest forecast is lower than the previous projection of 7% made by RBI Gov

"RBI Cuts GDP Growth Forecast to 6.8% Amid Festival Season Optimism"

The Reserve Bank of India (RBI) has reduced its GDP growth forecast for India to 6.8% for the second quarter of fiscal 2024-25, a decrease of 20 basis points. In its October bulletin titled "State of the Economy," the RBI attributed this revision to a slackening momentum observed in some high-frequency indicators, which were partially impacted by unusual heavy rainfall in August and September. This latest forecast is lower than the previous projection of 7% made by RBI Gov

RBI Bars Four NBFCs from Disbursing Loans Over High Interest Rates

The Reserve Bank of India (RBI) has taken a significant step by barring four non-banking financial companies (NBFCs) from sanctioning and disbursing loans starting October 21. The companies affected include Asirvad Micro Finance, Navi Finserv, Arohan Financial Services, and DMI Finance. This action comes in light of serious supervisory concerns related to high lending rates and non-compliance with regulatory standards. In a press release, the RBI emphasized its ongoing commitment to

RBI Bars Four NBFCs from Disbursing Loans Over High Interest Rates

The Reserve Bank of India (RBI) has taken a significant step by barring four non-banking financial companies (NBFCs) from sanctioning and disbursing loans starting October 21. The companies affected include Asirvad Micro Finance, Navi Finserv, Arohan Financial Services, and DMI Finance. This action comes in light of serious supervisory concerns related to high lending rates and non-compliance with regulatory standards. In a press release, the RBI emphasized its ongoing commitment to

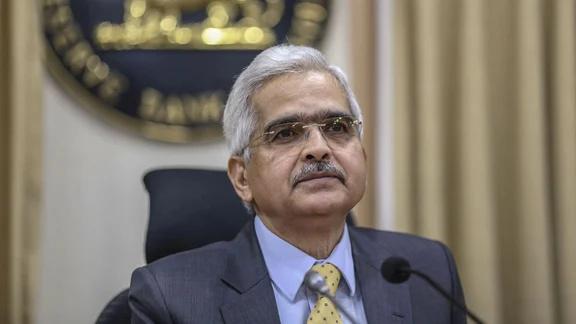

RBI's Stance on Inflation: A Tight Leash Amid Rising Risks

The Reserve Bank of India (RBI) is taking a cautious approach to inflation management following a slight rise in the latest inflation readings. During a policy address on Wednesday, RBI Governor Shaktikanta Das emphasized the need to keep inflation on a "tight leash" due to potential upside risks stemming from adverse weather conditions and ongoing geopolitical tensions. In August, India's retail inflation, measured by the Consumer Price Index (CPI), edged up to 3.65%,

RBI's Stance on Inflation: A Tight Leash Amid Rising Risks

The Reserve Bank of India (RBI) is taking a cautious approach to inflation management following a slight rise in the latest inflation readings. During a policy address on Wednesday, RBI Governor Shaktikanta Das emphasized the need to keep inflation on a "tight leash" due to potential upside risks stemming from adverse weather conditions and ongoing geopolitical tensions. In August, India's retail inflation, measured by the Consumer Price Index (CPI), edged up to 3.65%,