LIC Urges RBI to Introduce 100-Year Government Bonds for Long-Term Investments

Life Insurance Corporation of India (LIC) has requested the Reserve Bank of India (RBI) to introduce long-term government bonds, including 100-year bonds, to support their investment strategies for whole life insurance policies. This request was confirmed by Siddhartha Mohanty, Managing Director and Chief Executive of LIC, during an event in Mumbai. Speaking on the sidelines of the GCA25 conference, Mohanty explained that LIC’s investment portfolio heavily depends on long-term bonds to

LIC Urges RBI to Introduce 100-Year Government Bonds for Long-Term Investments

Life Insurance Corporation of India (LIC) has requested the Reserve Bank of India (RBI) to introduce long-term government bonds, including 100-year bonds, to support their investment strategies for whole life insurance policies. This request was confirmed by Siddhartha Mohanty, Managing Director and Chief Executive of LIC, during an event in Mumbai. Speaking on the sidelines of the GCA25 conference, Mohanty explained that LIC’s investment portfolio heavily depends on long-term bonds to

Best Alternatives to Fixed Deposits in India for Higher Returns and Secure Investments

Fixed deposits have long been considered a safe and reliable investment option in India, particularly among conservative investors. However, declining interest rates and rising inflation have made it increasingly difficult for FDs to offer returns that outpace the rising cost of living. With the Reserve Bank of India (RBI) reducing the repo rate, banks have responded by lowering FD rates, prompting investors to explore other options that provide higher returns while maintaining financial secu

Best Alternatives to Fixed Deposits in India for Higher Returns and Secure Investments

Fixed deposits have long been considered a safe and reliable investment option in India, particularly among conservative investors. However, declining interest rates and rising inflation have made it increasingly difficult for FDs to offer returns that outpace the rising cost of living. With the Reserve Bank of India (RBI) reducing the repo rate, banks have responded by lowering FD rates, prompting investors to explore other options that provide higher returns while maintaining financial secu

RBI Bulletin: Union Budget 2025 Tax Cuts to Boost Household Spending and Economic Growth

The Reserve Bank of India (RBI), in its latest bulletin released on February 19, stated that the tax cuts in the Union Budget 2025, along with moderating inflation, are expected to provide financial relief to the middle class and boost overall household spending. This announcement comes after the February Monetary Policy Committee (MPC) meeting, where the newly appointed RBI Governor, Sanjay Malhotra, emphasized the positive economic impact of the tax relief measur

RBI Bulletin: Union Budget 2025 Tax Cuts to Boost Household Spending and Economic Growth

The Reserve Bank of India (RBI), in its latest bulletin released on February 19, stated that the tax cuts in the Union Budget 2025, along with moderating inflation, are expected to provide financial relief to the middle class and boost overall household spending. This announcement comes after the February Monetary Policy Committee (MPC) meeting, where the newly appointed RBI Governor, Sanjay Malhotra, emphasized the positive economic impact of the tax relief measur

Stock Markets Fall Sharply Despite RBI Rate Cut and BJP Victory in Delhi Elections

Indian stock markets experienced a significant fall in early trade on Monday, even though the Reserve Bank of India (RBI) announced a rate cut and the Bharatiya Janata Party (BJP) emerged victorious in the Delhi Assembly elections. The benchmark indices opened lower and continued to decline amid growing selling pressure. The BSE Sensex lost over 600 points, while the NSE Nifty dropped nearly 200 points. The Sensex hit a low of 77,189.04, down from the previous session&

Stock Markets Fall Sharply Despite RBI Rate Cut and BJP Victory in Delhi Elections

Indian stock markets experienced a significant fall in early trade on Monday, even though the Reserve Bank of India (RBI) announced a rate cut and the Bharatiya Janata Party (BJP) emerged victorious in the Delhi Assembly elections. The benchmark indices opened lower and continued to decline amid growing selling pressure. The BSE Sensex lost over 600 points, while the NSE Nifty dropped nearly 200 points. The Sensex hit a low of 77,189.04, down from the previous session&

RBI Cuts Interest Rate by 25 bps: Impact on Markets, Banking & Economy

The Reserve Bank of India (RBI) announced a 25 basis points cut in the benchmark interest rate, marking its first reduction in five years. The decision, led by Governor Sanjay Malhotra, aims to boost economic activity but was met with mixed reactions from investors. Despite expectations of a rate cut, the market remained cautious as the RBI maintained a neutral stance without introducing additional liquidity measures. Foreign Institutional Investors (FIIs) continued outflows amid concerns ove

RBI Cuts Interest Rate by 25 bps: Impact on Markets, Banking & Economy

The Reserve Bank of India (RBI) announced a 25 basis points cut in the benchmark interest rate, marking its first reduction in five years. The decision, led by Governor Sanjay Malhotra, aims to boost economic activity but was met with mixed reactions from investors. Despite expectations of a rate cut, the market remained cautious as the RBI maintained a neutral stance without introducing additional liquidity measures. Foreign Institutional Investors (FIIs) continued outflows amid concerns ove

RBI Recruitment 2025: Apply for Medical Consultant Post

The Reserve Bank of India (RBI) is inviting applications for the position of Medical Consultant (MC) on a contract basis. This is an excellent opportunity for qualified medical professionals to work with RBI. The last date to apply is February 14, 2025, at 4:40 pm. Vacancy Details: The recruitment is for medical professionals with an MBBS degree, with a preference for those having postgraduate qualifications in General Medicine and at least two years o

RBI Recruitment 2025: Apply for Medical Consultant Post

The Reserve Bank of India (RBI) is inviting applications for the position of Medical Consultant (MC) on a contract basis. This is an excellent opportunity for qualified medical professionals to work with RBI. The last date to apply is February 14, 2025, at 4:40 pm. Vacancy Details: The recruitment is for medical professionals with an MBBS degree, with a preference for those having postgraduate qualifications in General Medicine and at least two years o

RBI’s Dr. Michael Patra: A Legacy of Insightful Monetary Policy and Quirky Farewell

Dr. Michael Debabrata Patra, who served as the Reserve Bank of India’s (RBI) Deputy Governor, has retired after nearly four decades with the central bank. Known for his strategic role in steering the RBI’s monetary policy, Patra became the face of the RBI during critical press conferences, answering the key questions on interest rates, inflation, and growth. Patra, who headed the monetary policy department for most of his tenure, was a key player in the decisions made by

RBI’s Dr. Michael Patra: A Legacy of Insightful Monetary Policy and Quirky Farewell

Dr. Michael Debabrata Patra, who served as the Reserve Bank of India’s (RBI) Deputy Governor, has retired after nearly four decades with the central bank. Known for his strategic role in steering the RBI’s monetary policy, Patra became the face of the RBI during critical press conferences, answering the key questions on interest rates, inflation, and growth. Patra, who headed the monetary policy department for most of his tenure, was a key player in the decisions made by

Madhya Pradesh High Court Grants 6 Weeks for Union Carbide Waste Disposal

The Madhya Pradesh High Court has given the state government six weeks to ensure proper disposal of Union Carbide factory waste in accordance with safety guidelines. This follows the shift of waste, sealed in 12 containers, from the defunct factory in Bhopal to a disposal site in Pithampur, about 250 km away, on January 2, 2025. The court’s decision comes after the state's Advocate General Prashant Singh expressed concerns about unrest in Pithampur due to misinformation about the wa

Madhya Pradesh High Court Grants 6 Weeks for Union Carbide Waste Disposal

The Madhya Pradesh High Court has given the state government six weeks to ensure proper disposal of Union Carbide factory waste in accordance with safety guidelines. This follows the shift of waste, sealed in 12 containers, from the defunct factory in Bhopal to a disposal site in Pithampur, about 250 km away, on January 2, 2025. The court’s decision comes after the state's Advocate General Prashant Singh expressed concerns about unrest in Pithampur due to misinformation about the wa

RBI Allows UPI Payments Through Third-Party Apps for Digital Wallets

The Reserve Bank of India (RBI) has made a significant change to the Unified Payments Interface (UPI) system by enabling UPI payments between verified digital wallets, also known as Prepaid Payment Instruments (PPIs), and third-party UPI applications. This new directive will allow users of digital wallets to make and receive UPI payments via any third-party UPI app, rather than being limited to the wallet’s own mobile application. The move is aimed at enhancing interoperability within t

RBI Allows UPI Payments Through Third-Party Apps for Digital Wallets

The Reserve Bank of India (RBI) has made a significant change to the Unified Payments Interface (UPI) system by enabling UPI payments between verified digital wallets, also known as Prepaid Payment Instruments (PPIs), and third-party UPI applications. This new directive will allow users of digital wallets to make and receive UPI payments via any third-party UPI app, rather than being limited to the wallet’s own mobile application. The move is aimed at enhancing interoperability within t

Indian Rupee Weakens Amid RBI Leadership Change and Central Bank Decisions

The Indian rupee opened at 84.83 against the US dollar on Monday, a depreciation of 4 paise compared to the previous close of 84.79. The decline in the rupee is largely attributed to the uncertainty following the announcement of a leadership transition at the Reserve Bank of India (RBI). Shaktikanta Das will be succeeded by Sanjay Malhotra, sparking initial concerns in the market. However, markets quickly adjusted to the news, with experts noting that the RBI is closely monitoring banking sys

Indian Rupee Weakens Amid RBI Leadership Change and Central Bank Decisions

The Indian rupee opened at 84.83 against the US dollar on Monday, a depreciation of 4 paise compared to the previous close of 84.79. The decline in the rupee is largely attributed to the uncertainty following the announcement of a leadership transition at the Reserve Bank of India (RBI). Shaktikanta Das will be succeeded by Sanjay Malhotra, sparking initial concerns in the market. However, markets quickly adjusted to the news, with experts noting that the RBI is closely monitoring banking sys

RBI Receives Bomb Threat via Email in Russian

On Thursday, the Reserve Bank of India (RBI) received a bomb threat via email, which was written in Russian. The threat, sent to the RBI's official website, claimed that the bank would be blown up. Following the threat, a case was registered at the Mata Rambai Marg (MRA Marg) police station in Mumbai, and an investigation has been launched. This incident comes after a similar threat was made to the RBI through its customer care number on November 16, with the caller claiming to

RBI Receives Bomb Threat via Email in Russian

On Thursday, the Reserve Bank of India (RBI) received a bomb threat via email, which was written in Russian. The threat, sent to the RBI's official website, claimed that the bank would be blown up. Following the threat, a case was registered at the Mata Rambai Marg (MRA Marg) police station in Mumbai, and an investigation has been launched. This incident comes after a similar threat was made to the RBI through its customer care number on November 16, with the caller claiming to

India's Inflation Drops to 5.48% in November Amid Rising Food Prices

India's inflation rate, based on the Consumer Price Index (CPI), moderated to 5.48% in November, down from 6.21% in October, according to the Ministry of Statistics and Programme Implementation. This easing, however, is still above the Reserve Bank of India's (RBI) target of 4%, with food prices continuing to drive inflationary pressure. The food inflation rate surged by 9.04%, continuing its trend of high costs. Economists had forecast a median inflation estimate of 5.5% fo

India's Inflation Drops to 5.48% in November Amid Rising Food Prices

India's inflation rate, based on the Consumer Price Index (CPI), moderated to 5.48% in November, down from 6.21% in October, according to the Ministry of Statistics and Programme Implementation. This easing, however, is still above the Reserve Bank of India's (RBI) target of 4%, with food prices continuing to drive inflationary pressure. The food inflation rate surged by 9.04%, continuing its trend of high costs. Economists had forecast a median inflation estimate of 5.5% fo

Sanjay Malhotra Appointed New Governor of RBI

Sanjay Malhotra, a 1990-batch IAS officer from Rajasthan, has been appointed as the 26th Governor of the Reserve Bank of India (RBI), succeeding Shaktikanta Das. The government announced that Malhotra will take charge from Wednesday for a term of three years. With a background in computer science from IIT Kanpur and a Master's in Public Policy from Princeton University, Malhotra has had a distinguished career spanning over three decades in various sectors, including finance, taxation, pow

Sanjay Malhotra Appointed New Governor of RBI

Sanjay Malhotra, a 1990-batch IAS officer from Rajasthan, has been appointed as the 26th Governor of the Reserve Bank of India (RBI), succeeding Shaktikanta Das. The government announced that Malhotra will take charge from Wednesday for a term of three years. With a background in computer science from IIT Kanpur and a Master's in Public Policy from Princeton University, Malhotra has had a distinguished career spanning over three decades in various sectors, including finance, taxation, pow

India's Foreign Exchange Reserves Rise to $658.1 Billion

India's foreign exchange reserves saw an increase to $658.1 billion for the week ending November 29, according to the Reserve Bank of India (RBI). This rise followed an eight-week decline, with a $1.5 billion increase from the previous week. In comparison, the reserves had dropped by $1.31 billion in the prior week, reaching $656.58 billion. Foreign investors have invested Rs 1.75 lakh crore into India's debt and equity markets in 2024. However, the month of November witness

India's Foreign Exchange Reserves Rise to $658.1 Billion

India's foreign exchange reserves saw an increase to $658.1 billion for the week ending November 29, according to the Reserve Bank of India (RBI). This rise followed an eight-week decline, with a $1.5 billion increase from the previous week. In comparison, the reserves had dropped by $1.31 billion in the prior week, reaching $656.58 billion. Foreign investors have invested Rs 1.75 lakh crore into India's debt and equity markets in 2024. However, the month of November witness

Households' Inflation Perception Rises, Confidence Dips Slightly

In November, the median perception of current inflation among households increased to 8.4%, up by 30 basis points from the previous survey round in September, according to the Reserve Bank of India (RBI) Households’ Inflation Expectations Survey. Meanwhile, expectations for inflation over the next three months moderated slightly by 10 basis points, reaching 9.1%. However, households' expectations for inflation a year ahead inched up by 10 basis points to 10.1%. The survey

Households' Inflation Perception Rises, Confidence Dips Slightly

In November, the median perception of current inflation among households increased to 8.4%, up by 30 basis points from the previous survey round in September, according to the Reserve Bank of India (RBI) Households’ Inflation Expectations Survey. Meanwhile, expectations for inflation over the next three months moderated slightly by 10 basis points, reaching 9.1%. However, households' expectations for inflation a year ahead inched up by 10 basis points to 10.1%. The survey

Indian Rupee Strengthens as RBI Keeps Rates Unchanged

The Indian rupee ended the trading session stronger after the Reserve Bank of India (RBI) decided to keep the benchmark interest rates unchanged, while unveiling measures aimed at improving liquidity in the banking system. The domestic currency gained 3 paise, closing at 84.70 against the US dollar, compared to 84.73 in the previous session. As part of the monetary policy changes, the RBI raised the interest rate ceiling on one-year Foreign Currency Non-Resident (FCNR) deposits by 200 basis p

Indian Rupee Strengthens as RBI Keeps Rates Unchanged

The Indian rupee ended the trading session stronger after the Reserve Bank of India (RBI) decided to keep the benchmark interest rates unchanged, while unveiling measures aimed at improving liquidity in the banking system. The domestic currency gained 3 paise, closing at 84.70 against the US dollar, compared to 84.73 in the previous session. As part of the monetary policy changes, the RBI raised the interest rate ceiling on one-year Foreign Currency Non-Resident (FCNR) deposits by 200 basis p

RBI Keeps Rates Unchanged, Lowers GDP Growth Forecast

On Friday, the Reserve Bank of India (RBI) announced it would keep the repo rate unchanged at 6.5% for the 11th consecutive time. This decision comes despite the GDP growth rate for the July-September quarter falling to a 7-quarter low of 5.4%, which was below the RBI's earlier projection of 7%. The RBI paused its rate hike cycle in April last year after raising rates by 250 basis points since May 2022. In the fifth bi-monthly monetary policy review for the current fiscal year,

RBI Keeps Rates Unchanged, Lowers GDP Growth Forecast

On Friday, the Reserve Bank of India (RBI) announced it would keep the repo rate unchanged at 6.5% for the 11th consecutive time. This decision comes despite the GDP growth rate for the July-September quarter falling to a 7-quarter low of 5.4%, which was below the RBI's earlier projection of 7%. The RBI paused its rate hike cycle in April last year after raising rates by 250 basis points since May 2022. In the fifth bi-monthly monetary policy review for the current fiscal year,

RBI Buys 27 Tonnes of Gold in October 2024, Boosting Reserves to 882 Tonnes

In October 2024, the Reserve Bank of India (RBI) made a significant move by adding 27 tonnes of gold to its reserves, bringing its total gold purchases for the year to 78 tonnes. This marks the highest level of purchases since 2009, when India acquired 200 tonnes from the International Monetary Fund (IMF). The RBI's total gold reserves now stand at 882 tonnes. In comparison, India had bought only 16 tonnes of gold in 2023. The RBI's gold purchase comes amid global economic i

RBI Buys 27 Tonnes of Gold in October 2024, Boosting Reserves to 882 Tonnes

In October 2024, the Reserve Bank of India (RBI) made a significant move by adding 27 tonnes of gold to its reserves, bringing its total gold purchases for the year to 78 tonnes. This marks the highest level of purchases since 2009, when India acquired 200 tonnes from the International Monetary Fund (IMF). The RBI's total gold reserves now stand at 882 tonnes. In comparison, India had bought only 16 tonnes of gold in 2023. The RBI's gold purchase comes amid global economic i

RBI to Hold Repo Rate, May Cut CRR Amid Slower Growth and High Inflation

The Reserve Bank of India’s Monetary Policy Committee (MPC) is expected to maintain the status quo on the benchmark repo rate at 6.5% in its upcoming meeting from December 4 to 6. Despite India's GDP growth slowing to 5.4% in the July-September quarter, economists suggest that inflation concerns will likely take precedence, making a rate cut unlikely in December. Retail inflation rose to 6.2% in October, exceeding the RBI’s target range of 2-6%. Though a repo rate cu

RBI to Hold Repo Rate, May Cut CRR Amid Slower Growth and High Inflation

The Reserve Bank of India’s Monetary Policy Committee (MPC) is expected to maintain the status quo on the benchmark repo rate at 6.5% in its upcoming meeting from December 4 to 6. Despite India's GDP growth slowing to 5.4% in the July-September quarter, economists suggest that inflation concerns will likely take precedence, making a rate cut unlikely in December. Retail inflation rose to 6.2% in October, exceeding the RBI’s target range of 2-6%. Though a repo rate cu

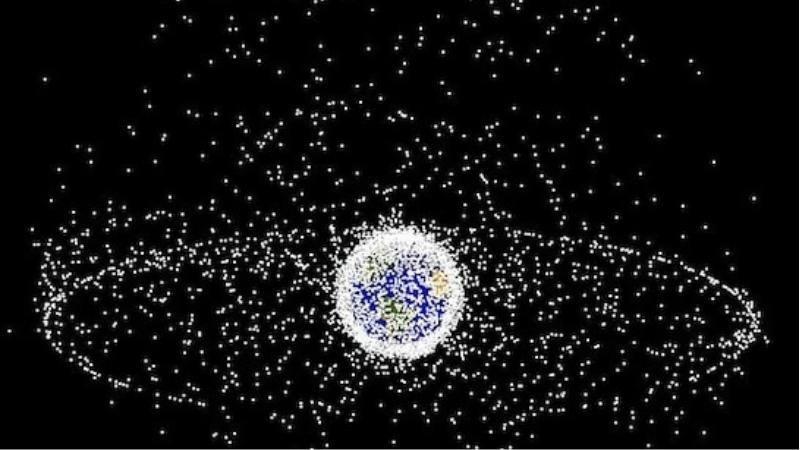

Experts Warn of Space Traffic Crisis Without Global Cooperation on Low Earth Orbit

The rapid increase in satellites and space junk is threatening the future of Low Earth Orbit (LEO), the most accessible region of space. Experts and industry insiders have raised alarms, stating that without international cooperation and data sharing, LEO could soon become overcrowded and unsafe. According to the United Nations, more than 14,000 satellites, along with over 120 million pieces of debris, are already in orbit, with many more expected in the coming years. This growing congestion

Experts Warn of Space Traffic Crisis Without Global Cooperation on Low Earth Orbit

The rapid increase in satellites and space junk is threatening the future of Low Earth Orbit (LEO), the most accessible region of space. Experts and industry insiders have raised alarms, stating that without international cooperation and data sharing, LEO could soon become overcrowded and unsafe. According to the United Nations, more than 14,000 satellites, along with over 120 million pieces of debris, are already in orbit, with many more expected in the coming years. This growing congestion